The importance of accurate payroll management

Payroll management is a critical aspect of any business's operations, involving the administration of employee financial records, including salaries, wages, bonuses, deductions, and net pay. An accurate payroll system ensures that employees are paid on time and that all legal obligations are met.

Managing payroll can be complex, with challenges such as staying up-to-date with tax laws, handling employee benefits, and ensuring accurate record-keeping. These tasks can be particularly daunting for small to medium-sized businesses, sole proprietors, non-profit organizations, and apartment associations in Estonia.

Key Components of Payroll Management

Ensuring that employee data is accurate and up-to-date is fundamental to payroll management. This includes personal details, tax codes, and banking information.

Businesses must adhere to Estonian tax laws and regulations, which require meticulous attention to detail and an understanding of the legal framework.

Timely and accurate payroll processing is essential to maintain employee trust and satisfaction. This involves calculating pay based on hours worked, salaries, and any other compensation entitlements.

Proper record keeping and reporting are necessary for transparency and compliance. Businesses must maintain detailed records for each employee and report payroll information to the relevant authorities.

Benefits of Accurate Payroll Management

Accurate payroll contributes to a positive work environment and can significantly impact employee satisfaction and retention.

Meticulous payroll management minimizes the risk of errors that could lead to legal penalties and fines, safeguarding the business's reputation and finances.

Accurate payroll data is crucial for effective financial management and budgeting, allowing businesses to make informed decisions.

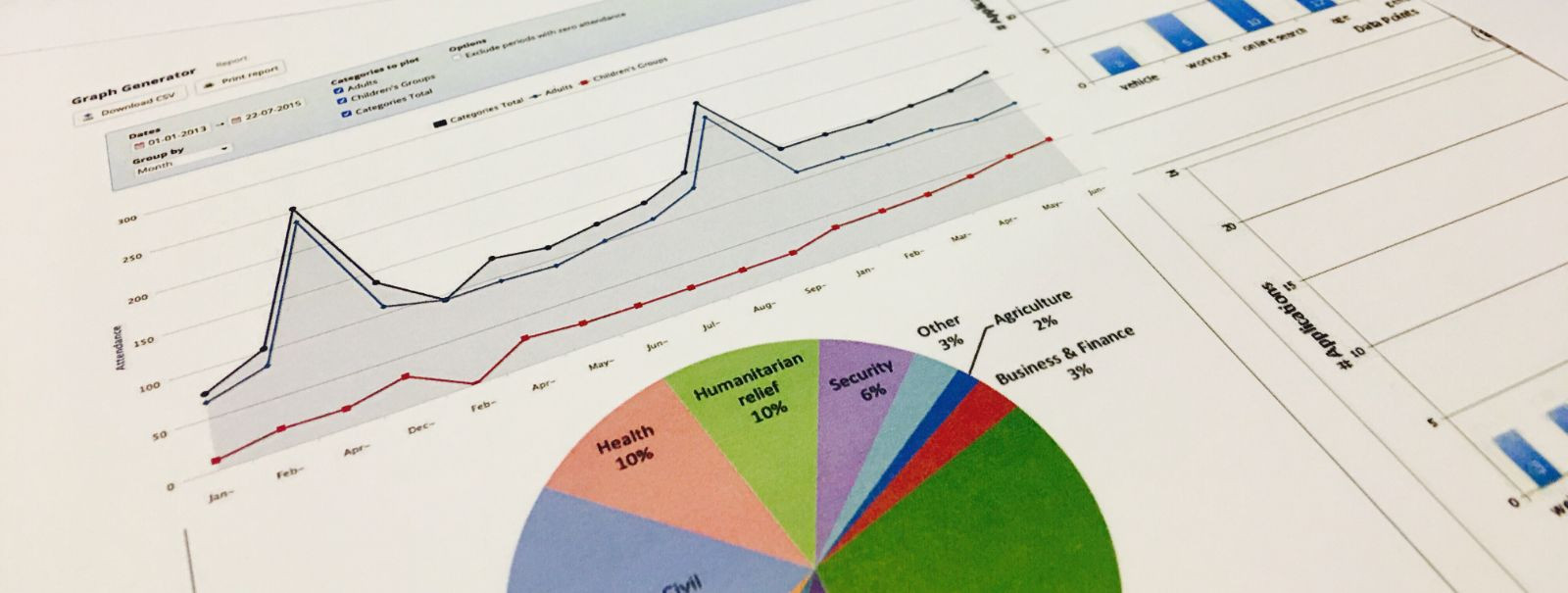

Payroll data can provide insights into labor costs, productivity, and other key performance indicators that are vital for strategic planning.

Best Practices for Ensuring Payroll Accuracy

Investing in reliable payroll software can streamline the payroll process, reduce errors, and save time.

Conducting regular payroll audits and reconciliations ensures accuracy and compliance with financial regulations.

Keeping abreast of changes in tax laws and employment regulations is essential for maintaining payroll compliance.

Outsourcing payroll to experts like TINEVEX OÜ can alleviate the burden of payroll management, allowing businesses to focus on their core activities.

Comments (0)