The future of crypto trading: what to expect in the next decade

The landscape of cryptocurrency trading is an ever-evolving frontier, with the next decade poised to bring about transformative changes that will redefine how we interact with digital assets. As we look ahead, it's essential to consider the technological, regulatory, and market dynamics that will shape the future of crypto trading.

Technological Advancements in Crypto Trading

Artificial Intelligence (AI) and Machine Learning (ML) are set to revolutionize crypto trading by providing enhanced predictive analytics, automated trading algorithms, and personalized trading strategies. These technologies will enable traders to make more informed decisions and manage risks more effectively.

Blockchain technology will continue to evolve, leading to faster transaction speeds, reduced costs, and increased scalability. Innovations such as sharding, layer-two solutions, and cross-chain interoperability will be at the forefront of this evolution.

As the value and volume of crypto transactions increase, so does the need for robust security measures. Expect to see advancements in encryption, multi-factor authentication, and decentralized security mechanisms that will make trading more secure.

Regulatory Landscape and Compliance

The next decade will likely witness significant changes in the global regulatory framework for cryptocurrencies. Harmonization of regulations across jurisdictions could lead to a more stable and predictable trading environment.

Compliance with regulatory standards will become a priority for trading platforms. Enhanced transparency through the use of blockchain technology will help in building trust with users and regulators alike.

User Experience and Accessibility

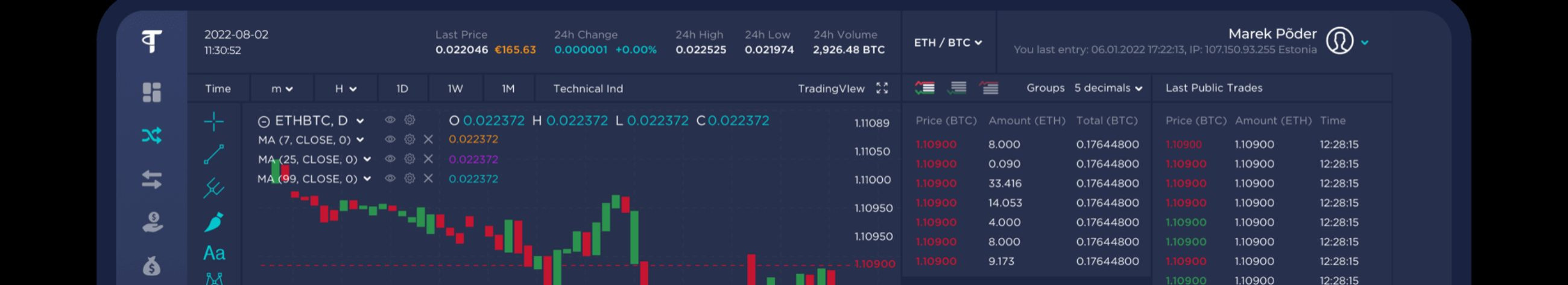

Trading platforms will focus on delivering seamless and intuitive user experiences, with interfaces that cater to both novice and experienced traders. This will include the integration of educational resources to help users understand market dynamics.

Mobile-first strategies will become increasingly important as traders seek to manage their portfolios on-the-go. Platforms will need to ensure that their mobile applications offer full functionality and real-time data.

Decentralized Finance (DeFi) and Crypto Trading

DeFi will continue to intersect with crypto trading, offering decentralized exchanges (DEXs), lending platforms, and yield farming opportunities. This will provide traders with a wider range of financial instruments and greater control over their assets.

The lines between traditional finance and DeFi will blur, with more financial institutions adopting blockchain technology to offer crypto-related services. This could lead to a more integrated financial ecosystem.

Tokenization and Asset Diversification

The tokenization of assets will create new investment opportunities, allowing traders to invest in fractional ownership of real estate, art, and other non-traditional assets.

Tokenization will extend beyond digital assets to include real-world assets, making them more accessible and liquid. This will enable a more diverse and resilient trading environment.

Market Trends and Investment Strategies

As the market matures, we can expect a shift towards more sophisticated investment strategies, including the use of derivatives, hedging, and algorithmic trading.

Emerging markets will play a crucial role in the growth of the crypto space, with increasing adoption and innovation driving market expansion.

Comments (0)