HUUM SAUNA OÜ current status

This company's branding has already reached 2,666 peopleand his is followed by 4 Storybook users.On average, the company has been rated 4.3 points.and commented 32 times.

's activity report 2022

Since 2020, HUUM Sauna OÜ represents the HUUM brand in the North American market.

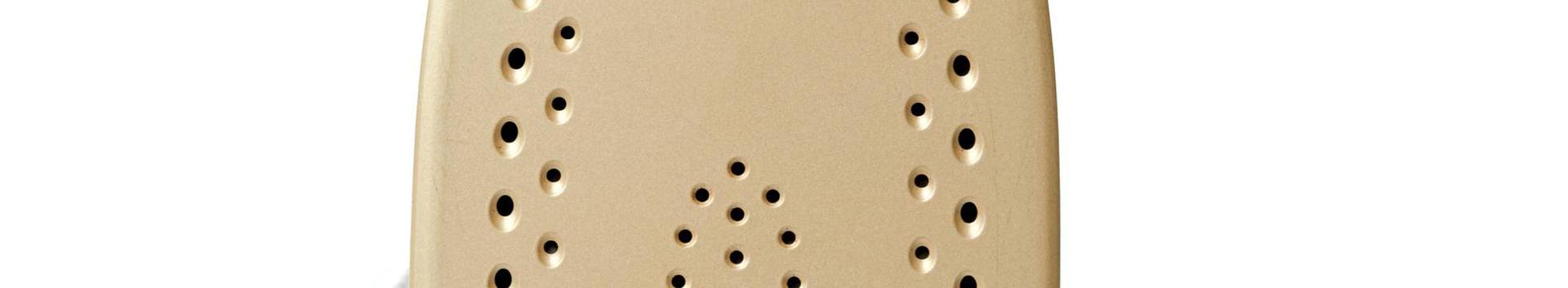

HUUM Sauna OÜ sells HUUM OÜ products, which are sauna heaters and control electronics, to the North American market. In 2020, the

North American turnover was a total of 465,454 euros. In 2021, it was already 2,127,560 euros and during the reporting period 4,750,321 euros. In 2023, the turnover in the USA,

Canada and Mexico will already be over 2.5 million euros.

In addition to selling sauna heaters and control electronics, the company provides a service to customers to add an APP function to the control electronics.

The company also deals with the certification of relevant products for the American market. During the reporting period, the company invested over 55,000 euros in product certification.

Huum Sauna OÜ started working in the Japanese market in 2021. At the end of the reporting period, a subsidiary has been established in Japan, which will be launched this fiscal year. In 2022, the turnover for the Japanese market was 125,306 euros. The certification of products for the Japanese market has begun.

Both markets are developing markets. Despite the economic slowdown in the American market, we expect sales volume growth.

We are just entering the Japanese market. Since it is an old and conservative culture, the process may take time.

The 2021 fiscal year ended with a significant loss and the company's equity requirement was not met. The 2022 profit did not fully cover the loss incurred and the equity requirement is also not met as of 31.12.2022. In the period following the reporting period, the management has reviewed the cost structure and implemented measures to control costs. Relations with partners are well organized and sales volume has grown by over 11% in the first five months compared to the same period in 2022.

In the first five months, the company made a profit of 336,564 euros and as of 31.05.2023, the equity is 266,554 euros.

Financial indicators: 2022 2021 1. Debt ratio 1.1 1.2 (liabilities / total assets) 2. Solvency ratio 0.5 0.2 (cash + unpaid bills / short-term liabilities) 3. Sales profitability 1.6% -8.6% (net profit / sales revenue * 100) 4. Short-term debt coverage ratio 0.7 0.7 (current assets / short-term liabilities)

Comments (0)