5 ways to streamline your expense reporting process

Efficient expense reporting is a critical component for the financial health and operational efficiency of any business. Streamlining this process not only saves time but also reduces errors and improves compliance. Here are five ways businesses can enhance their expense reporting procedures.

1. Implement a Mobile Expense Reporting Solution

Mobile expense reporting apps allow employees to submit expenses on-the-go, reducing delays and improving accuracy. These apps often come with features such as automatic mileage tracking and currency conversion, which simplify the expense reporting process.

When selecting a mobile app, look for user-friendly interfaces, compatibility with various devices, and the ability to integrate with your existing accounting systems.

2. Adopt a Cloud-Based Expense Management System

Cloud-based expense management systems offer accessibility from anywhere, at any time. They facilitate collaboration, provide secure data storage, and can scale with your business.

Choose a system that integrates seamlessly with your accounting software, HR systems, and ERP solutions to ensure a unified financial ecosystem.

3. Establish Clear Expense Reporting Policies

A well-defined expense policy sets clear expectations and guidelines for employees, which helps prevent fraudulent claims and ensures compliance with tax regulations.

Regular training sessions can help employees understand the importance of compliance and how to use expense reporting tools effectively.

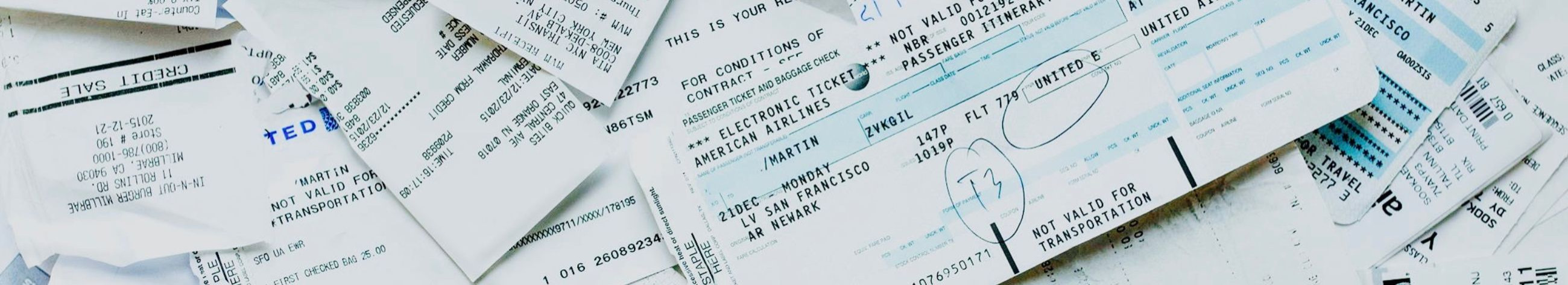

4. Utilize Receipt Scanning and Data Extraction Technology

Receipt scanning technology allows users to capture receipt information via a smartphone camera, which is then automatically populated into the expense report.

Data extraction tools can significantly reduce manual data entry errors and save time by pulling relevant information from receipts and invoices directly into the expense management system.

5. Leverage Real-Time Reporting and Analytics

Real-time reporting provides immediate insight into spending patterns, helping businesses make informed decisions quickly.

Analytics tools can identify trends, flag outliers, and help optimize the expense reporting process for better financial control.

Comments (0)