What is Credit Score?

Credit Score is the only research-based credit management tool in Estonia that you can conveniently use in the business, customer management and accounting software you are used to working with.

Credit score principle

The credit score model has been developed in cooperation with the Software Technology Development Center and the data researchers of the University of Tartu during the 3-year applied research work.

The credit score model uses thousands of features and has been developed using machine learning methods that include self-learning algorithms. These algorithms are able to detect hidden relationships and make predictions based on them.

The model predicts the possibility of corporate insolvency or compulsory liquidation with an accuracy of 99.5% over the next 12 months.

Simply put, a credit score uses known information about companies that goes back up to 1.5 years and combines it with new data that may change on a daily basis (such as debt information and its patterns, board changes and patterns, reporting, tax payment, etc.) .

The research article of the Credit Score of the Information Register was published in the publication of the prestigious International Scientific Conference.

Corporate credit score

The credit score calculates the credit risk of all Estonian companies on a daily basis on constantly changing data. However, traditional credit risk models are based on data that is updated on average once a year! Thus, traditional credit risk assessment models are unable to respond to changes in, for example, the middle of the year. However, the credit score processes all data sets related to the company on a daily basis, so it can react and inform the user immediately.

The usual background check is a time-consuming craft, from gathering information from various sources to analyzing it. With Intelligent Credit Score, this work can be done automatically and can be conveniently used in real time right in the middle of business processes.

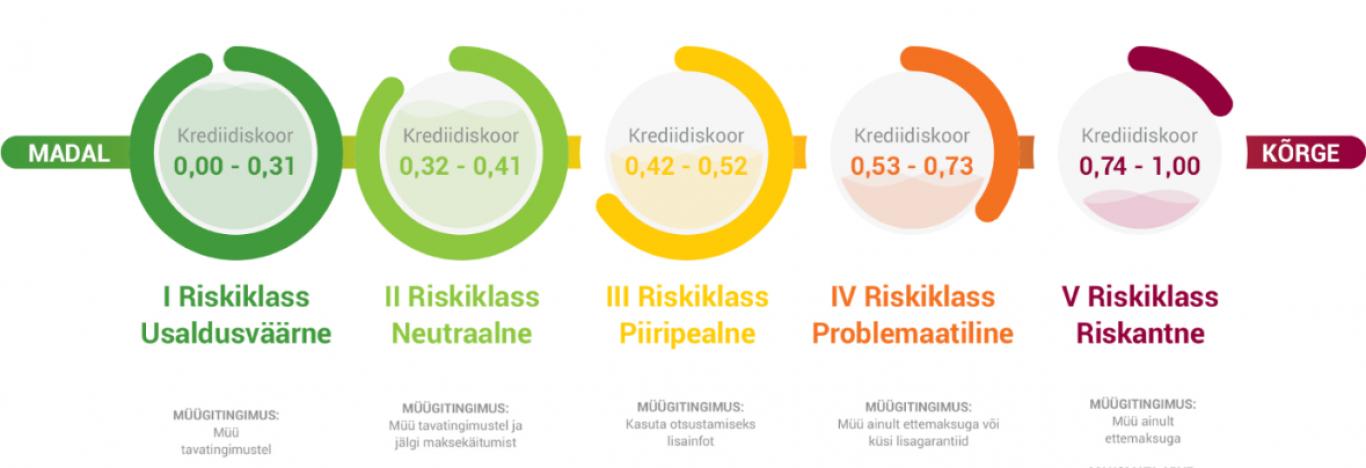

RISK CLASSES TO HELP MAKE CREDIT DECISIONS

The scores calculated by the credit score model always range from 0 to 1, where 0 means low and 1 means high credit risk. In order to simplify credit decisions and act faster, the score is divided into 5 risk classes. Risk class-based codes of conduct help you make better decisions at the point of sale and beyond the due date if the invoice is outstanding.

Credit score of entrepreneurs (deciders)

The credit score of a member of the Management Board is calculated by the arithmetic average of all related companies of the member of the Management Board - based on the real-time credit score of companies with valid links and the credit score of companies with invalid links at the time the member left the company.

For example, if the credit score of a former member of the management board company is risky today, but it was reliable at the time of leaving the management board, then the impact of this risky company on the credit score of the member of the management board is positive.

The credit score is objective

With the help of a credit score, companies can easily assess the credit risk of new customers and keep an eye on the solvency of their long-term customers. It helps to make quick and wise decisions - whether and under what conditions to give credit to the customer. The assessment of each client is based on the same methodology, which is not influenced by subjective assessments.

"Accurate and intelligent credit management every day. Where it's needed most."

Kommentaarid (0)